In 1991, after writing several letters to the Province of Ontario on being an unpaid tax and money collector for them, I resigned my position with them by burning my vendors permit in their office with media in attendance.

The Federal Government initiated action when the 1993 federal election was called and charged me with failing to file GST returns. However they did not charge me with failing to collect the taxes which I wanted to argue was slavery and therefore unconstitutional. I again stopped filing GST returns two years later and have not filed income tax return since 1991. The government gave up on any further legal proceedings. This situation basically remained as such for the next 20 years.

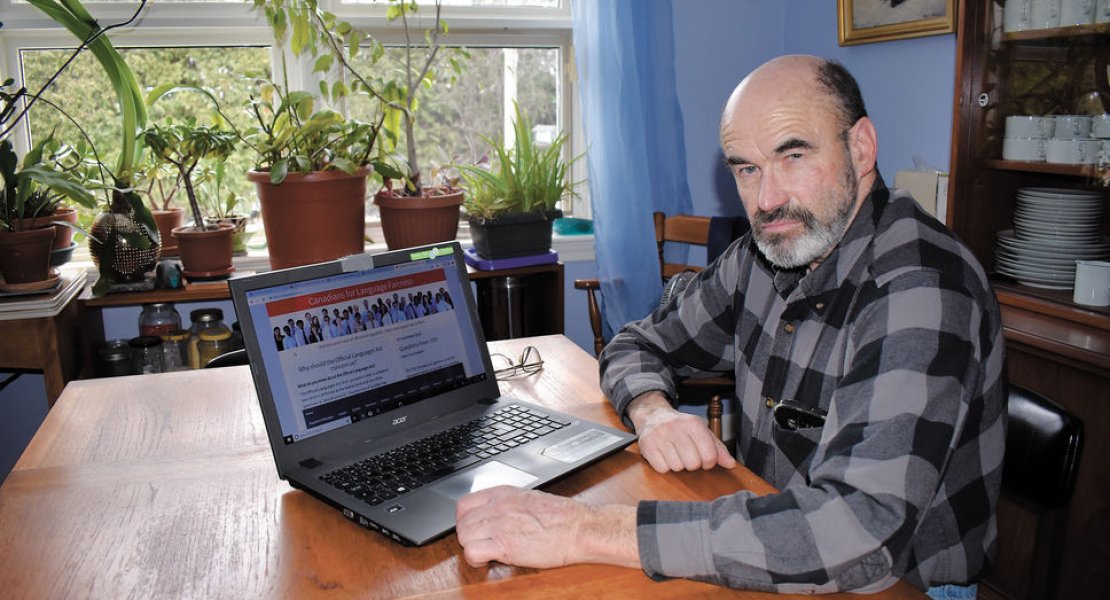

After that I gave public presentations across the country on what I had done with refusing to collect money for the government. Eventually I wrote a book about it in 2014 called Tea Party of One. A year after finishing my book tour, on November 2015, the CRA served me with a notice to file income tax returns for the past nine years. I was given until March 2016 to comply. The CRA failed to do anything until the Ontario provincial election in 2018, when I ran as a candidate for the Ontario Libertarian Party. A few weeks after the debate on Rogers TV I was served with a summons to appear in court for non-filing of income tax returns.

In July 2018 I made my first appearance in court. I was given a first release of disclosure. The CRA had a very detailed record of my activities for the past 20 years. The Crown had even included the reasons why they didn’t prosecute me earlier, “Low Tax Potential”. What finally made it “worthwhile” was this comment in the 2015 notes of a CRA official: “He is an author, he does public presentation, he is a tax protestor, prosecute”. It was now a matter of punishing me because of the book I had written. The proceedings on this matter lasted a year before the actual trial took place.

My friend David Lindsay deserves all the credit for putting together my defence, which took the CRA by complete surprise. The initial defence was to raise a Constitutional Question on the legality of taking someone to court for a political opinion, which is what my book was about. But when we saw what the CRA was putting forward as their argument to prosecute me, we made a shift in the strategy.

The original notices served on me had a demand that I file them at the CRA official’s office on Laurier St. in Ottawa. The CRA was then relying solely on the Affidavits filed by their agents as proof enough to prosecute me. These affidavits essentially evidenced that the CRA official did a careful search of the CRA records and did not find my returns. I proved at court (by way of the CRA official’s admission in evidence) that there is no provision in the Income Tax Act nor any other statute, that authorizes him to demand that I, or anyone else, file income tax returns to any specific address. Even the Judge agreed that he could find no such law.

Once that was established, I then asked the CRA official how he would search the CRA database and records for all of Canada. His response was that he relied upon and used, my alleged Social Insurance Number, or SIN. My defence was to show that nowhere did the CRA prove that the SIN that they were using to prosecute me was really mine. All the CRA official could do was say that the number was on the file all along, but he did not verify the accuracy of the SIN at source. At that point it was hearsay evidence which is not permitted in these types of cases. The judge agreed that there was no evidence by the CRA proving that the SIN in question was actually mine. I got my decision October 24, 2019. I was found “Not Guilty.

I was very happy with this decision. But I do not want to remain sitting around for them to come back at a later day with basically the same approach. The entire intent of the CRA was to punish me for challenging their authority and proceedings on how the CRA does business with the people that it fleeces every year. Not just what we pay to them, but who does the work collecting the money for the government. My intent was to end this practice of slavery by small business for the government. That is why during the latest trial, I mentioned to David Lindsay that should I come out of this with a victory, it can’t stop here, and he agreed. This last court action by the government towards me was just “The End of the Beginning.”

- Log in to post comments